Description

Renko Bar EA: A Brief Introduction of the Renko Chart.

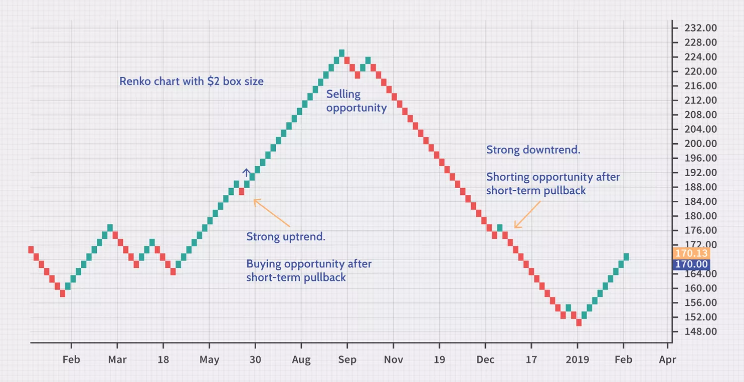

A Renko Chart is a type of chart that is formed using using price movements. It differs from most charts which are developed based on price and standard time. The Renko Chart was first developed by the Japanese who named it after their word for bricks called ‘’ranga’’. A new brick is created when the price moves a specified price amount. An up brick is typically colored white or green, while a down brick is typically colored black or red. Renko Bars are formed in Bricks called box sizes. Renko charts are designed to filter out noise and minor price movements to make it easier for traders to focus on important trends. Renko charts typically only use closing prices based on the chart time frame chosen. For example, if using a daily time frame, then daily closing prices will be used to construct the bricks.

Renko Bar EA: Methods of Calculating Renko Bricks.

Renko Bar EA: Methods of Calculating Renko Bricks.

- Average True Range(ATR): A Brick also known as the Renko Block size can be any price size such as $0.10, $0.50, $5, and so on. The Average True Range automatically calculates the block sizes in a regular candlestick chart. This means that the Renko Box Sizes are formed based on the ATR.

- The Traditional Method: New bricks are only created when price movement is at least as large as the pre-determined brick size.The traditional method of the formation of renko charts is that they are composed of bricks that are created at 45-degree angles to one another. Consecutive bricks do not occur beside each other.

Renko Bar EA: Functionality

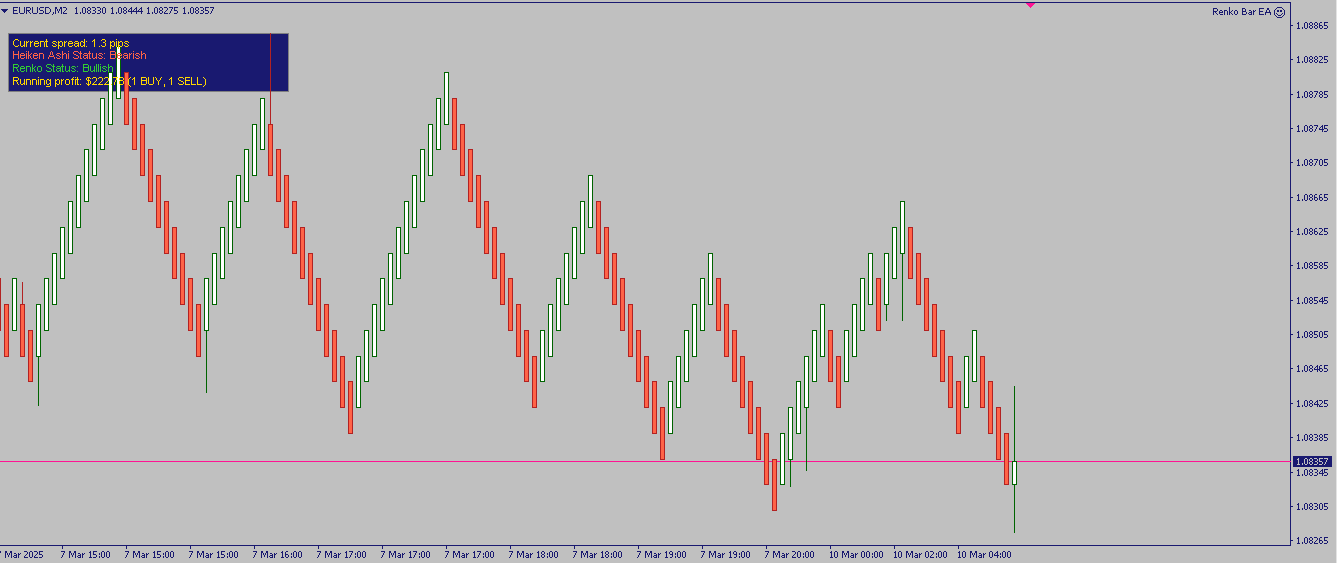

It takes some time for the Renko Bar Candle to be formed, so this EA will save you the stress of waiting in order for you to execute the trade manually. The Renko Bar EA automatically executes the trade for you and close it on a reverse signal; that is if the signal changes from Bullish to bearish and vice versa.

The EA opens and close only 1 trade at a time based on the Renko Brick. No matingaling, No hedging. The Renko Trader EA is a Metatrader expert advisor that can trade renko bricks. The Renko Bar EA has a trend detector and is capable of buying only in an uptrend, or sell in a downtrend market movement. It comes with the possibility to use a fixed lotsize or a percentage of the free margin to open the trades, and all the other trade management features that traders use: break-even, stop-loss, take profit, trailing stop etc.

Contact US Now and Grab your Copy

Al Bundy –

Hi, do you know, if your EA is working with Blueberry Markets? Which Broker do you recommend?

Karl Wieczorek –

Okay, in one trade (on a reasonable account) this EA paid for itself, I really don’t need to say anymore…

Shaun Clint Hendricks –

Thank you for this awesome product, the range filtering is the best, i have been trying to build this but its so hard to achieve so i celebrate you for this extremely well built trading machine.

GERALDO FERREIRA MESQUITA –

Good options for set up!!! It is for professional not for dreamer!!!

Eugen Mischenko –

I testing this version of Renko Bar EA for three weeks and i need to say its very risky EA, position holding time over a week eurusd with drowdown about 150€ on 800€ deposit and finaly profit 1,7€. In three weeks i have profit 13€ -49$ rent price. One Deposit of 250€ was burned in 2 days, maybe my mistake, because the lot was to high 0.05. This ea maybe would work good on a big deposit about 10K.

ivan.atos29 –

Olá, boa tarde. Adquiri o Exp TickSniper PRO FULL, Excelente robô. Só preciso de uma informação: As vezes ele perde muito em uma única operação. Como faço para diminuir as perdas nesta situação?

XenofoX –

Reliable product. Fast response from the dev. You have lots of control over the trade that you want to make. A clear indicator if the product is working or not in your terminal/broker. Dev maintains the products keep up to date. EA works in all Forex Pair. Fair price for the Renko Bar EA and what it can do.

Daniel Shapira –

this EA helped me to turn my initial 1k into 2k in less than a month(some manual trading was applied)

the author is very supportive and the EA is working very well

Christopher Lamar –

The author is attentive, support and responses. this EA is profitable.

Shashank Rai –

I love the simplicity of this EA. Very easy to optimize – was able to install and get it functional in a few minutes. This EA uses a very interesting trade management algorithm. My recommendation would be don’t go wild with the recovery factor and recovery trades because that is similar to revenge trading. It has a 93% win rate, which is astounding! If it’s a prop account you are trading, target conservative settings and ensure the drawdown is less than 6% overall. I’ve also noticed if the trade duration starts to exceed >600 minutes, you are better off closing the position manually and letting the EA find new opportunities. Also, if you target around $1500 per 0.01 lot for prop firms, you will never have any issues. Should be able to average 30 – 50% return on capital with basic settings. Enough to pass a challenge + get some cream on top. Then you can go wild with the settings 🙂

Filomena –

It’s great that you are getting thoughts from this piece of writing as well as

from our discussion made here.

Feel free to visit my blog post; useful content