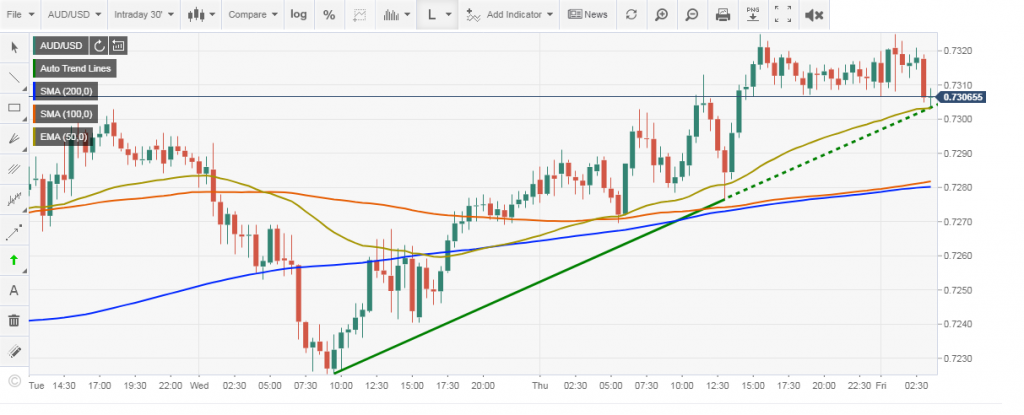

AUD/USD Pair is extending the advance above 0.7300 on upbeat Chinese Caxixin Services PMI and US debt ceiling vote passage. RBA’s Financial Stability Report (FSR) talks up on the economic outlook. Focus shifts to the US NFP.

Speculative interest awaits US employment data for more hints on tapering.

AUD/USD pair corrective advance is not enough to affect the dominant bearish trend.

AUD/USD pair fell to 0.7169 but is finishing a second consecutive week pretty much unchanged in the 0.7260 price zone. Demand for the American currency and plummeting equities usually undermine the aussie, although a nice comeback in gold prices partially offset their effects on AUD/USD.

Inflation, fear and the Fed

Markets rotated around the mounting inflationary pressures, slowing economic comeback and chances of tighter monetary policies in major economies. News coming from China and the Evergrande property giant crisis also affected investors’ mood, as the company missed for a second consecutive week an offshore bond coupon payment. Given that the company has a 30-day grace period, the financial sector has taken it quietly. However, the situation could become a severe issue in the next few weeks.

US Federal Reserve Chair Jerome Powell participated in several events, and his words were closely followed by speculative interest. The head of the Fed referred to stubbornly high inflation likely to extend into 2022, although he insisted it would likely be temporary. He blamed it on bottlenecks, as he said that “the current inflation spike is really a consequence of supply constraints meeting solid demand, and that is all associated with the reopening of the economy, which is a process that will have a beginning, a middle and end

The Reserve Bank of Australia will have a monetary policy meeting on Tuesday, October 5. The central bank is widely anticipated to maintain the status quo, with action not expected until February 2022. However, market players will likely look for hints from Governor Philip Lowe and the policymakers assessment of the economic situation

Gold shined on Thursday, adding roughly $40.00 per ounce to turn green for the week. The bright metal trades around $1,760 a troy ounce after hitting a monthly low of $1,721.59 on Wednesday. For a change, gold benefited from the dismal market mood, overshadowing the greenback as safe haven.

US employment in the eye of the storm

US data released these days was mostly encouraging. Durable Goods Orders rose by more than anticipated in August, up 1.8%, while Q2 Gross Domestic Product was confirmed at 6.7% QoQ, better than previously estimated. Also, the ISM Manufacturing PMI beat expectations at 61.1 in September. However, CB Consumer Confidence contracted to 109.3 in September from 115.2 in the previous month.

Critical employment-related data disappointed investors, particularly considering that Fed Powell said that he wants to see one more good employment report before moving into a tighter monetary policy. Initial Jobless Claims jumped to 362K in the week ended September 24. Also, the September ISM Manufacturing PMI employment sub-component printed at 50.2, worse than the 50.9 expected although better than the previous 49.

Australia published August Retail Sales, which printed at -1.7%, better than anticipated, and Building Permits for the same month that was up 6.8% MoM.

The upcoming week will be a busy one, as the US will release the official September ISM Services PMI next week, foreseen at 61.3, although the focus will be on employment. The ADP survey is expected to show that the private sector added 475K new jobs in September, better than the previous 374K. Finally, on Friday, the country will publish the Nonfarm Payrolls employment report. The country is expected to have created a total of 500K new jobs in the month, while the Unemployment Rate is expected to have contracted to 5.1%.

Australia will release the Commonwealth Bank Services PMI and the official AIG figure, both for September and TD Securities Inflation for the same month.